Tip Pools and Tip-Outs: What’s Legal, What’s Not.

Don’t let your employer fund payroll with your tips.

Let’s discuss who can be paid from a tip pool—and why employers must prove it’s legal.

1) The burden is on the employer—period.

If your tips go into a pool, the employer must prove the pool was lawful and that every dollar went only to employees who customers intended to tip. You don’t have to “catch” your employer doing something wrong. Suspicion plus incomplete explanations is enough to raise the issue—the employer must supply the proof.

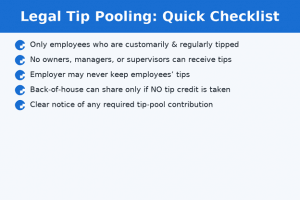

2) Who may be paid from a tip pool? Only employees who are “customarily and regularly tipped” by customers.

The question of who may lawfully be paid from a tip pool depends on whether an employee is “customarily and regularly tipped.” This determination depends on whether the employee is performing customer-service functions that a customer would regularly, and as a matter of custom, leave a tip in recognition of the service provided by the employee. To make this determination, courts look to the customer’s intent: Did the customer who left the tip intend for a portion of the tip to go to the employee in question? To meet this test, an employer must show that it only uses the tip pool to pay employees who are:

- regularly interacting with customers (i.e. customer-facing roles); and

- performing customer service, customer-facing duties that customarily, as a matter of custom, elicit a tip from the customer (i.e. the customer intended to tip the employee for the service they provided).

Job titles don’t matter. What matters are the actual duties being performed by the employee in question. Employees who are directly serving customers (traditional servers and bartenders) usually qualify; owners, managers, and supervisors never qualify; employees who do not regularly perform customer-service, customer-facing duties like cooks, janitors, maintenance personnel, office administrators, and back-of-house positions (dishwashers, cooks, prep, expeditors, janitors, and any other employee who does not directly interact with or directly serve customers) do not qualify.

3) “They work hard and deserve it” isn’t a legal justification.

Everyone deserves fair pay—but out of the employer’s pocket, not out of your tips. Imagine a grocery store docking its cashier’s paychecks to cover the cost of cleaning the grocery store. Absurd—and, yes, unlawful. It is no different in the restaurant industry: if a restaurant wants to pay its janitors, cooks, dishwashers, or other non-tipped workers more, it must do so using its own money, not by using its servers’ tips to fund the wages of its non-tipped workers through a so-called “tip pool.”

Want to thank a coworker? You’re free to voluntarily reach into your pocket—without pressure or coercion—and thanking them however you choose. Just like using your tips to pay for anything else—it’s YOUR money, you decide how YOU want to spend it. What the law forbids is employers taking a portion of your tips under the guise of a so-called “tip pool” and then using those tips to pay non-tipped workers and unlawfully reduce its own out-of-pocket labor costs.

4) Bright-line rule: Employers can’t take or use your tips for any other purpose.

Whether labeled “tip pool,” “tip-out,” “tip share,” or any other label, employers can’t keep or redirect any part of your tips for the business, to reduce its labor costs, or for anything other than distributing them to employees who the customer intended to tip. And again, the employer must prove that all tips were lawfully distributed to the employees who are customarily and regularly tipped by customers.

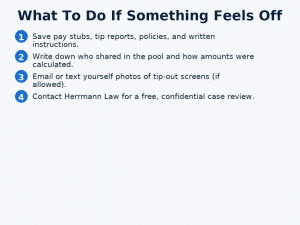

What to do if something feels off

- Keep any Records you can. Keep copies of your pay stubs, POS reports, tip-out reports/breakdowns, employee policies/handbook, and any other documents your employer has given you or made available to you.

- Act quickly. Unlawful pools can mean recovering misdirected tips and back wages (often doubled), plus attorneys’ fees.

- Seek Legal Advice. Contact Herrmann Law to speak with an attorney for advice and guidance unique to your specific situation. We have represented thousands of restaurant workers across the United States. We offer free consultations and contingency fee agreements.

About Herrmann Law: We represent restaurant workers nationwide in unpaid wage, overtime, and tip theft cases. Questions about your situation? Contact us by submitting your information on our website or by calling or texting our office at 817-479-9229

You can also learn more by visiting our Legal Center for Restaurant Workers.

Learn more about tipping laws and your rights

Learn more about tipping laws and your rights

- Illegal Tip Pooling (Guide)

- Tip Pooling vs Tip Credit: What’s the Difference?

- Understanding Tip Credit Abuse

- Side Work Laws for Restaurant Employees

- Legal Center for Restaurant Workers

- Contact Herrmann Law

Disclaimer: The information on our website is provided for general informational purposes only, and is not legal advice. Laws, including wage-and-hour laws, vary by state and change over time. The facts specific to your situation and the laws in your state may lead to different outcomes. Do not act on this information without consulting a licensed attorney. For guidance on your specific situation, consult an attorney. No attorney-client relationship is created with Herrmann Law, PLLC and none of our attorneys represent you until Herrmann Law, PLLC has executed a written agreement, agreeing to represent you.